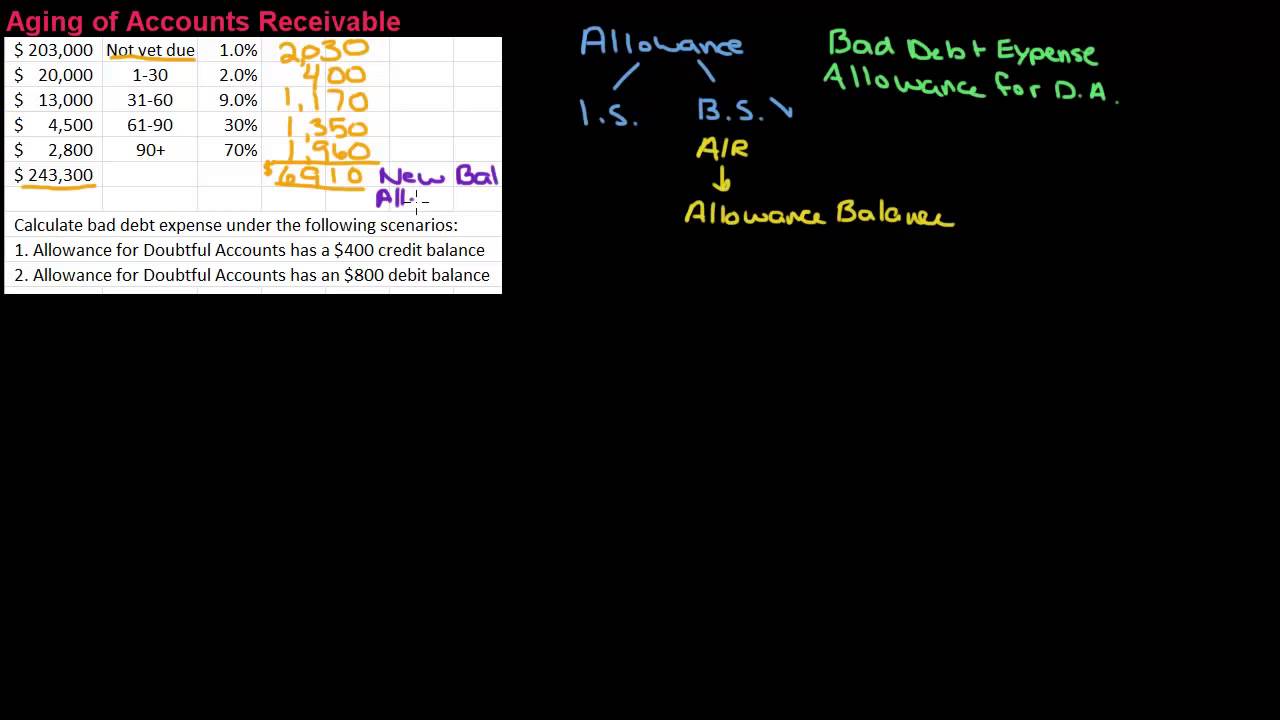

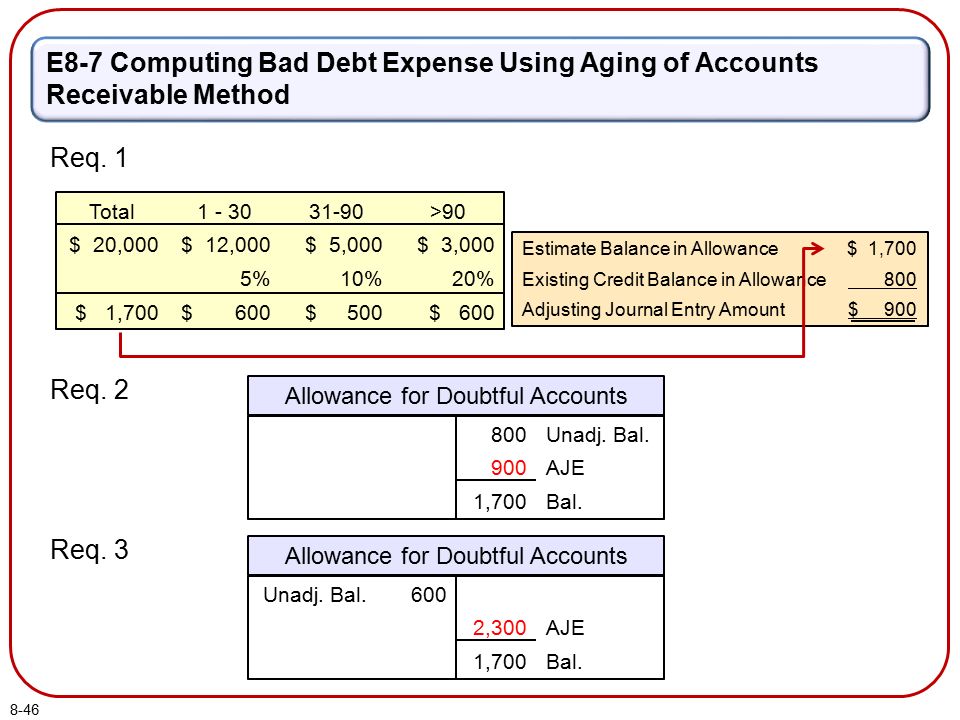

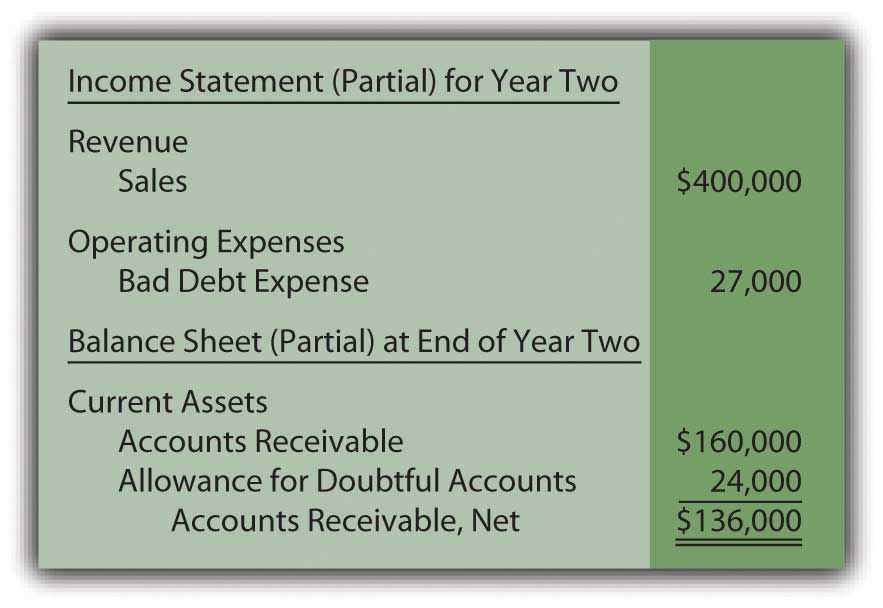

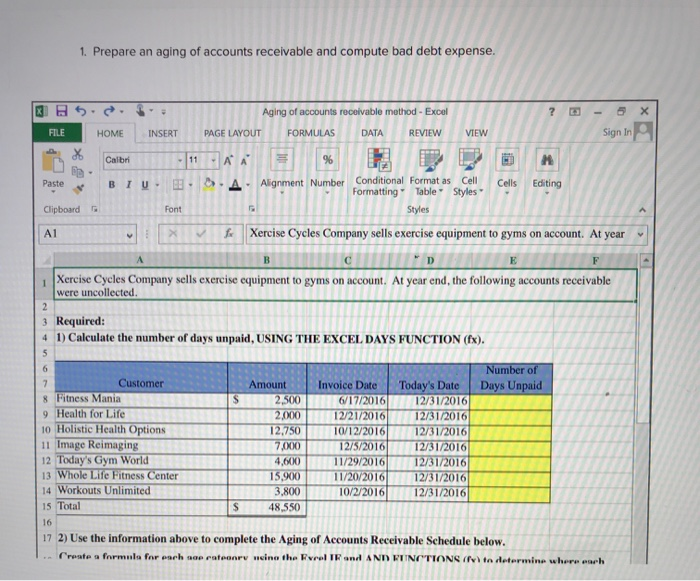

77+ pages calculate the total estimated bad debts on the below information 2.1mb. Debts 0 - 30 325000 x 01 3250 31 -60 91000 x 04 3640 61 - 90 50000 x 05 2500 91 - 120 17000 x 08 1360 Over 120 11000 x 11 1210 11960 Estimate of Uncollectible Prepare the year-end adjusting journal entry to record the bad debts using the allowance method and the aged uncollectible accounts receivable determined in a. So the break even point is 8200 pizzas. Calculate the total estimated bad debts based on the below information. Read also calculate and learn more manual guide in calculate the total estimated bad debts on the below information Assume the current balance in Allowance for Doubtful Accounts is a 3000 credit.

Prepare the year-end adjusting journal entry to record the bad debts using the aged uncollectible accounts receivable determined in above. Of the above accounts 5000 is determined to be.

Estimating Bad Debts Allowance Method

| Title: Estimating Bad Debts Allowance Method |

| Format: PDF |

| Number of Pages: 259 pages Calculate The Total Estimated Bad Debts On The Below Information |

| Publication Date: January 2017 |

| File Size: 1.3mb |

| Read Estimating Bad Debts Allowance Method |

|

Calculate the total estimated bad debts on the below informationB.

Prepare the year-end adjusting journal entry to record the bad debts using the aged uncollectible accounts receivable determined in above. Calculate the total estimated bad debts based on the above information. Prepare the year-end adjusting journal entry to record the bad debts using the. Calculate the total estimated bad debts on the below information. A Calculate the total estimated bad debts based on the above information. For target profit.

Bad Debt Aging Of Accounts Receivable Method

| Title: Bad Debt Aging Of Accounts Receivable Method |

| Format: PDF |

| Number of Pages: 317 pages Calculate The Total Estimated Bad Debts On The Below Information |

| Publication Date: July 2018 |

| File Size: 1.4mb |

| Read Bad Debt Aging Of Accounts Receivable Method |

|

Ca Accounting Books Doubtful Debts

| Title: Ca Accounting Books Doubtful Debts |

| Format: eBook |

| Number of Pages: 160 pages Calculate The Total Estimated Bad Debts On The Below Information |

| Publication Date: March 2020 |

| File Size: 3.4mb |

| Read Ca Accounting Books Doubtful Debts |

|

Ca Accounting Books Doubtful Debts

| Title: Ca Accounting Books Doubtful Debts |

| Format: eBook |

| Number of Pages: 173 pages Calculate The Total Estimated Bad Debts On The Below Information |

| Publication Date: May 2018 |

| File Size: 2.3mb |

| Read Ca Accounting Books Doubtful Debts |

|

Direct Write Off And Allowance Methods For Dealing With Bad Debt Accounting In Focus

| Title: Direct Write Off And Allowance Methods For Dealing With Bad Debt Accounting In Focus |

| Format: ePub Book |

| Number of Pages: 192 pages Calculate The Total Estimated Bad Debts On The Below Information |

| Publication Date: February 2021 |

| File Size: 1.2mb |

| Read Direct Write Off And Allowance Methods For Dealing With Bad Debt Accounting In Focus |

|

Receivables Bad Debt Expense And Interest Revenue Ppt Download

| Title: Receivables Bad Debt Expense And Interest Revenue Ppt Download |

| Format: ePub Book |

| Number of Pages: 151 pages Calculate The Total Estimated Bad Debts On The Below Information |

| Publication Date: April 2018 |

| File Size: 2.3mb |

| Read Receivables Bad Debt Expense And Interest Revenue Ppt Download |

|

Estimating Bad Debts Allowance Method

| Title: Estimating Bad Debts Allowance Method |

| Format: eBook |

| Number of Pages: 230 pages Calculate The Total Estimated Bad Debts On The Below Information |

| Publication Date: May 2017 |

| File Size: 2.3mb |

| Read Estimating Bad Debts Allowance Method |

|

Good Debt Vs Bad Debt Simple Accounting

| Title: Good Debt Vs Bad Debt Simple Accounting |

| Format: eBook |

| Number of Pages: 152 pages Calculate The Total Estimated Bad Debts On The Below Information |

| Publication Date: April 2020 |

| File Size: 3.4mb |

| Read Good Debt Vs Bad Debt Simple Accounting |

|

Chapter 8 Receivables Bad Debt Expense And Interest

| Title: Chapter 8 Receivables Bad Debt Expense And Interest |

| Format: PDF |

| Number of Pages: 345 pages Calculate The Total Estimated Bad Debts On The Below Information |

| Publication Date: September 2018 |

| File Size: 1.1mb |

| Read Chapter 8 Receivables Bad Debt Expense And Interest |

|

Estimating Bad Debts Allowance Method

| Title: Estimating Bad Debts Allowance Method |

| Format: PDF |

| Number of Pages: 177 pages Calculate The Total Estimated Bad Debts On The Below Information |

| Publication Date: January 2020 |

| File Size: 1.2mb |

| Read Estimating Bad Debts Allowance Method |

|

1 Prepare An Aging Of Accounts Receivable And Chegg

| Title: 1 Prepare An Aging Of Accounts Receivable And Chegg |

| Format: eBook |

| Number of Pages: 214 pages Calculate The Total Estimated Bad Debts On The Below Information |

| Publication Date: October 2021 |

| File Size: 1.8mb |

| Read 1 Prepare An Aging Of Accounts Receivable And Chegg |

|

Calculate Bad Debt Expense Methods Examples Accountinguide

| Title: Calculate Bad Debt Expense Methods Examples Accountinguide |

| Format: PDF |

| Number of Pages: 285 pages Calculate The Total Estimated Bad Debts On The Below Information |

| Publication Date: March 2020 |

| File Size: 1.4mb |

| Read Calculate Bad Debt Expense Methods Examples Accountinguide |

|

Prepare the year-end adjusting journal entry to record the bad debts using the allowance method and the aged uncollectible accounts receivable determined in a. To compute for estimated bad debts simple multiply the receivable balance by the percentage. Assume the unadjusted balance in Allowance for Doubtful Accounts is a exist7000 credit.

Here is all you need to learn about calculate the total estimated bad debts on the below information Calculate the total estimated bad debts on the below information. The computation is shown below. Prepare the year-end adjusting journal entry to record the bad debts using the. Receivables bad debt expense and interest revenue ppt download good debt vs bad debt simple accounting ca accounting books doubtful debts bad debt aging of accounts receivable method direct write off and allowance methods for dealing with bad debt accounting in focus 1 prepare an aging of accounts receivable and chegg Assume the current balance in Allowance for Doubtful Accounts is a 8000 debit.

0 Comments